SMM, January 20:

Spot primary aluminum prices fell by 80 yuan/mt compared to the previous trading day, with SMM A00 spot aluminum closing at 20,260 yuan/mt. Aluminum scrap market quotations mainly followed the decline. In the short term, the fundamentals remain tight on the supply side. Currently, suppliers are gradually entering the Chinese New Year holiday, reducing their willingness to sell, and market trading activity has decreased.

Today, baled UBC aluminum scrap was quoted at 14,850-15,700 yuan/mt (excluding tax), and shredded aluminum tense scrap was quoted at 16,350-17,850 yuan/mt (liquid aluminum, excluding tax).

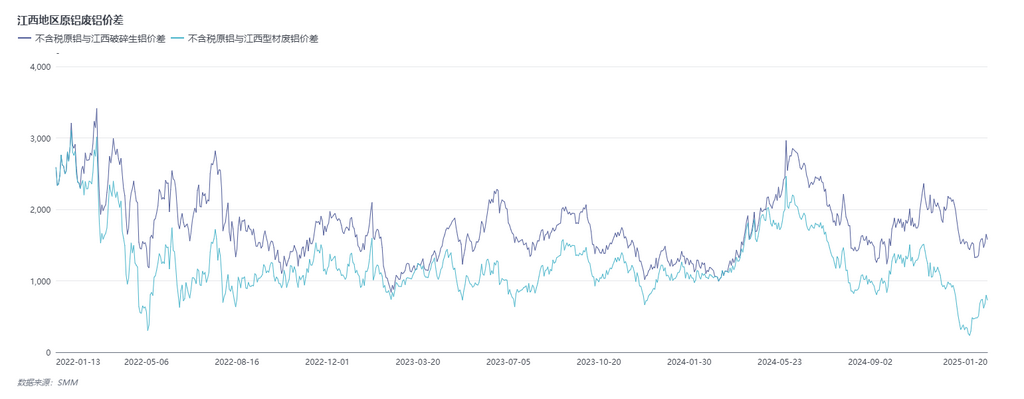

As the Chinese New Year holiday approaches, traders are showing reluctance to sell, and some small factories have started their holidays, tightening market supply. Overall transactions were moderate. In the short term, the price difference between primary metal and scrap is expected to fluctuate rangebound.